WealthBriefing has been speaking to private client wealth managers and lawyers about the kind of structures that clients want to use, how they are affected by changing government tax rules and other regulations, as well as the changing face of inter-generational wealth transfer. In this article, WealthBriefing talk to Ugo Privitera, a registered foreign lawyer at Withers, the international law firm.

29 March 2019

28 March 2019

Raconteur: The Future of Insurance 2019

Will AI be making all insurance decisions within the next decade? Will driverless cars drive premiums up, even if you don’t have one? The Future of Insurance special report, published in The Times, covers the irrepressible impact technology is having on the profession. It explores what can be done to avoid the looming talent crisis, and the ways in which pay-as-you-live policies are changing the sector. There is comment on why digital technology can enhance human capabilities, but should not replace them and an infographic on how incumbent insurers are reacting to digital disruption as rising competition presses them to transform services and even business models.

27 March 2019

MFSA: Consultation Document on Guidance for Credit Institutions, Payment Institutions and Electronic Money Institutions opening accounts for FinTechs

Cognisant of the sector specific risks which may be brought about by FinTech, the Malta Financial Services Authority ( MFSA ) and the Financial Intelligence Analysis Unit ( FIAU ) have decided to jointly issue a Guidance Document for Credit Institutions, Payment Institutions and accounts for FinTechs. The Guidance Document is intended to assist such Institutions to acquire a better understanding of risks of any prospective customers, active in technology reliant areas, prior to servicing them. The scope of this Consultation is to obtain industry feedback in relation to this Guidance Document, which is annexed to this paper, prior to proceeding with its adoption.

26 March 2019

WealthBriefing: Brexit's Effect On Trusts - An Exploration

What will the impact of Brexit be for those who hold trusts, and how else will it affect their tax affairs? WeathBriefing recently talked to a senior private client lawyer.

Mauritius: Revocation of the Management Licence of Alan Harley Corporate Services Ltd (previously known as ‘Rhema Group Global Family (R2GF) Ltd’)

PUBLIC NOTICE

Revocation of the Management Licence of Alan Harley Corporate Services Ltd (previously known as ‘Rhema Group Global Family (R2GF) Ltd’) - Ref: ENF/26C2019/1

The Financial Services Commission, Mauritius (the “FSC Mauritius”) hereby gives public notice that the Management Licence of Alan Harley Corporate Services Ltd (the “Management Company”), situated at 8th floor, The Core Tower, CyberCity, Ebene and bearing licence number MC16000189, has been revoked pursuant to section 7(1)(c)(vi) of the Financial Services Act 2007 (the “FSA”) with effect from 19 February 2019.

The Management Company has been directed by the FSC Mauritius to initiate the necessary actions for the orderly dissolution of its business and the discharge of its liabilities as per the Insolvency Act 2009.

26 March 2019

25 March 2019

The Cyber Threat Landscape: Confronting Challenges to the Financial System

Targeted network intrusions against banks are now happening on a weekly basis, and the financial sector must step up efforts to defend against the growing threat.

PDF

Raconteur: The Future of Data 2019

Is data the new oil? Will Facebook ever fully recover public trust? Is there a need for data scientists any more? The Future of Data special report, published in The Times, explores what the future looks like for the business’s most valuable commodity. It covers the new discipline of “infonomics”, which is helping teach business leaders how to handle corporate intelligence, as well as the ways in which artificial intelligence (AI) can help companies wring insights from their unstructured data. It also features an examination of the ethical and legal quandaries resulting from police use of analytics and an infographic highlighting the volume of data generated in a single day.

22 March 2019

Shifting Gears: How the world’s leading financial centres are entering a new phase of strategic action on green and sustainable finance

The world’s financial centres are the locations where supply and demand for green and sustainable finance will be matched. This report presents the first findings from an in-depth assessment of actions in 13 of these hubs, all members of the Inter national Network of Financial Centres for Sustainability (FC4S) across Africa, the Americas, Asia and Europe. The assessment reveals 10 key insights on how financial centres are mobilizing their expertise, connectivity and capital to help solve some of the world’s toughest financing challenges:

- A New Form of Public Private Partnership: Nearly two thirds of financial centre initiatives on green and sustainable finance are partnerships between the private and public sectors, giving them unique ability to link policy and practice.

- Overcoming Barriers to Growth: The top three barriers faced by financial centres are i) a lack of green financial products, ii) inconsistent standards and iii) insufficient market demand. Lack of a shared language for green and sustainable finance is a key constraint, highlighting the need for continued dialogue between public and private stakeholders on taxonomies.

- Going Beyond Climate: Climate change continues to be a major focus for activities branded as “sustainable” but FC4S members recognize need to broaden their offering to include other environmental priorities (e.g. circular economy, natural capital, and conservation finance) as well as social themes, such as financial inclusion and impact investing

- Policy innovation is a Key Driver: New policy initiatives and action by financial regulators are a key driver in half the financial centres, with system-wide initiatives and debt capital markets the most cited examples. In a quarter of centres, policy and regulation are touching upon equity and debt capital markets, insurance, investment, banking and system-wide action.

- A Diversity of Financial Instruments: Over 75% of respondents noted the presence of different debt instruments related to green and/or sustainable finance – primarily green bonds. Equity instruments are on the rise, with 25 % of respondents noting the presence of structured products, closed-ended funds, and discretionary mandates.

- Sector Evolution Varies: Investment and asset management is the most mature sector with respect to green and sustainable finance in most centres, while green banking is evolving and insurance has the furthest to go.

- Professional services are growing rapidly: Over 75% of respondents acknowledged the presence of sustainability rating services and consulting firms; other services (sustainability research, labelling, legal, clean techs and carbon trading) are present in some financial centres.

- Priorities for Future Action: Leading financial centres have identified further product development, improved data collection and better market standards as top priorities for further development.

- Focus on Innovation: Applying financial technology (fintech) solutions to sustainable finance challenges is a major focus for financial centres, with several FC4S members establishing specific projects aimed at fostering innovation – including accelerator programmes.

- Increasing International Collaboration: FC4S member centres are working more closely together on sustainable finance, including through bilateral projects. More and more centres are seeking to join the FC4S Network to benefit from collaboration opportunities.

17 March 2019

UWI: “Dirty” money + How to wash dirty money (part 2)

“Dirty” money

Several US banks found to be laundering money paid fines of $ 3 billion, and European banks paid $ 6 billion

How to wash dirty money (part 2)

About 2 trillion “dirty” dollars are laundered annually

15 March 2019

Court declares the Kenya-Mauritius Double Taxation Agreement Unconstitutional

The Kenya High court today declared void and unconstitutional the Double Tax Avoidance Agreement (DTAA) between Kenya and Mauritius. In reading the Judgement, Justice W. Korir granted Tax Justice Network Africa’s (TJNA) submission by declaring void Legal Notice No. 59 of 2014 which renders the Kenya/Mauritius DTAA void and unconstitutional. The long-awaited judgement is in reference to TJNA’s challenge of the constitutionality of the Kenya-Mauritius DTAA signed in May 11, 2012 on the following grounds:

- The government failed or neglected to subject the Kenya-Mauritius Double Taxation Avoidance Agreement to the due ratification process in line with the Treaty Making and Ratification Act 2012 as a contravention of Articles 10 (a), (c) and (d) and 201 of the Constitution of Kenya

- That Legal Notice Legal Notice 59 of 2014 is therefore invalid and that the Cabinet Secretary for Treasury should immediately commence the process of ratification in conformity with the provisions of the Treaty Making and Ratification Act 2012.

The high court ruled that due process as laid out in the Kenya Constitution was not followed and hence the Kenya Mauritius DTA ‘ceased to have effect and became void in accordance with the Kenyan law.’

Mr Alvin Mosioma the Executive Director of TJNA said ‘This ruling is ground breaking not just for Kenya but other African countries. We welcome this ruling as a validation of our argument that requires all DTAA’s to be subject to the constitutionally required ratification process as enshrined on Articles 10 (a to c) and 201 of the Constitution of Kenya. The ruling is a first step in the right direction in ensuring proper and wider stakeholder consultations on matters of national interest.’ This judgment validates our call for African countries to review all their tax treaties particularly those signed with tax havens. Evidence has shown that contrary to their objectives, these DTAs have led to double non-taxation and resulted to massive revenue leakage for African countries. The ruling further underscores our position that DTAs signed especially with tax havens have been avenues of tax avoidance practices denying African countries the much sought-after revenues to finance development.

TJNA’s Policy Lead-Tax and Investments, Jared Maranga said of the ruling ‘’This ruling affects not only the Kenya Mauritius DTA, but also has legal implications for all other treaties signed under the Constitution. It rightly pushes us to rethink the costs, benefits and motivations around signing DTAs in the first place. We should therefore set up a DTA policy framework – which sets out the basic minimums the country should consider while signing bilateral tax agreements.

Double Tax Agreements have a direct bearing to the taxing rights of states. The governments should therefore put in place mechanisms to ensure effective public participation as part of the treaty ratification process.”

TJNA calls on the Kenya government to revisit all other recently signed DTAs including those with UAE, Netherlands, China and South Korea and those under negotiation to ensure that they are compliant with this new ruling. The role of parliament is not only critical but also constitutionally mandatory in the treaty ratification process. We call upon the Kenyan parliament to rise us to this opportunity and play their legislative role in scrutinising future DTAs to ensure that they do not undermine domestic resource mobilisation efforts. DTAs that are not well thought out have been a subject of abuse by multinational corporations especially through treaty shopping and round tripping which impact on the revenues that countries realise out the associated investments.

“TJNA intends to ensure that all recently signed treaties and future similar tax negotiations are consistent with this ruling and are not in contravention with the laid down laws and procedures” added Mr Mosioma.

14 March 2019

13 March 2019

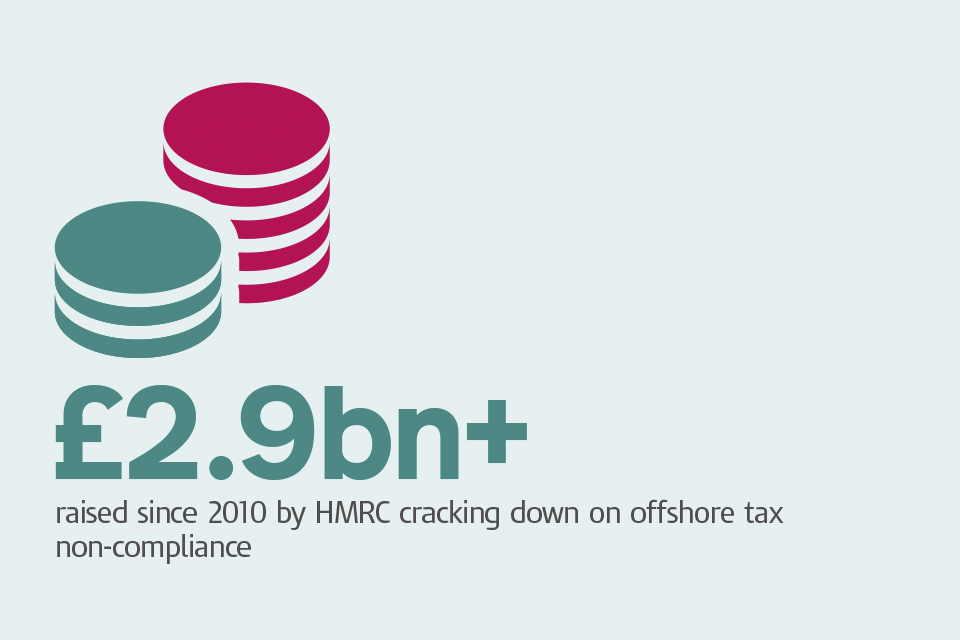

UK: HMRC - No Safe Havens 2019

The vast majority comply with their obligations and pay the UK tax due on their UK and overseas activities. However, a minority do not.

This strategy establishes new objectives, reflecting the UK’s substantial progress in tackling offshore non-compliance since our last strategy in 2014.

It sets out how HMRC will continue to ensure the correct UK tax is paid, by helping taxpayers meet their obligations and responding appropriately to those who pay less than they should.

Additionally, the UK will continue to champion greater international cooperation to tackle offshore non-compliance.

Mauritius: EU Assessment of Third–Country Tax Jurisdictions

The Council of the European Union, on 12 March 2019, issued a press release updating its blacklist of non-cooperative jurisdictions for tax purposes. The blacklist contains 15 jurisdictions namely American Samoa, Guam, Trinidad & Tobago, US Virgin Islands, Barbados, United Arab Emirates, Marshall Islands, Aruba, Belize, Bermuda, Fiji, Oman, Vanuatu and Dominica.

As a result of the prompt commitment taken by the Government of Mauritius on the 4th of February 2019, Mauritius does not feature on the said blacklist.

Other committed jurisdictions, including Australia and Morocco, as well as Mauritius have undertaken to take necessary actions in line with best international tax standards by the end of 2019.

Mauritius remains committed to uphold its adherence to international norms and best practices and the Mauritian authorities will continue to work closely with stakeholders in ensuring the good repute of the jurisdiction.

Raconteur: The Future of Money 2019

More than eight million UK adults (17 per cent of the population) would not cope in a cashless society, but with payment systems increasingly moving away from traditional money, what are the alternatives? The Future of Money special report, published in The Times, covers the tensions between traditional banks and fintechs over financial inclusion and SME lending and asks experts for their predictions for the future. It explores the pros and cons of digital fiat money, the current questions over cryptosecurity and how Brexit could undermine anti-money laundering initiatives. Also featured is an infographic on how consumer caution is holding us back from going fully cashless.

11 March 2019

The Global Financial Centres Index 25 (GFCI 25)

Today Z/Yen Partners and the China Development Institute (CDI) publish the twenty-fifth Global Financial Centres Index (GFCI 25). The GFCI rates 102 financial centres. The top twenty and the main headlines are shown below.

The main Headlines include:

Leading Centres

Western Europe

Asia/Pacific

North America

Eastern Europe And Central Asia

Middle East And Africa

Latin America And The Caribbean

Island Centres

Mark Yeandle, Director of Z/Yen and the author of the GFCI, said: "London remains second despite many people predicting that it may fall further. New York is still at the top for now but Hong Kong, Singapore and Shanghai are closing in fast.”

The main Headlines include:

Leading Centres

- New York remains in first place in the index, just seven points head of London. Hong Kong is only four points behind London in third and Singapore remains in fourth place;

- Shanghai remains ahead of Tokyo in fifth place in the index although Tokyo gained ten points in the ratings;

- Toronto rose 27 points and gained four places to seventh. Zurich, Beijing, and Frankfurt remained in the top ten.

Western Europe

- This region did well after a mixed performance in GFCI 24. Thirteen of the top 15 Western European centres rose in the ratings with particularly strong performances by Monaco, Madrid and Edinburgh. Only Luxembourg and Amsterdam saw modest declines;

- The centres that are most likely to benefit from Brexit did well, with Zurich, Frankfurt, Paris, and Dublin all gaining ground. Amsterdam was the only centre in Western Europe that dropped more than ten points in the ratings.

Asia/Pacific

- Most Asia/Pacific Centres performed well. Of the top twenty centres in the region, only Osaka saw a modest decline with the others rising or remaining as they were in GFCI 24;

- There has been a strong trend of Asia/Pacific centres improving over several years. The top eight centres in the region are now in the top fifteen centres in the whole index;

- Melbourne, Jakarta, and GIFT City (Gujarat) all showed strong increases in GFCI 25.

North America

- North American centres also did well in GFCI 25 with most centres rising in the ratings. Of particular note is the performance of Toronto, Montreal and Vancouver, the three leading Canadian centres. All three showed strong increases in the ratings. Toronto rose four places to seventh overall and Montreal is now in 18th place;

- Washington DC regained the ground that it lost in GFCI 24 with a rise of 34 points. This rise resulted in it climbing four places to 32nd overall.

Eastern Europe And Central Asia

- There were significant gains for Astana, Istanbul and Prague. Astana only officially launched its financial centre in 2018, and it is unusual for such a new centre to perform so strongly;

- Tallinn made a lot of ground in GFCI 24 but fell back this time despite a growing reputation as a strong FinTech centre.

Middle East And Africa

- Dubai, Casablanca, and Abu Dhabi continued to rise in the index. Doha lost some of the ground it made in GFCI 24;

- Kuwait City and Nairobi were new entrants to the index, with Kuwait ranking 57th in its first entry.

Latin America And The Caribbean

- There were mixed results in the region with five centres rising in the ranks and three declining. The Cayman Islands, Panama, and Bermuda performed strongly.

Island Centres

- The British Crown dependencies showed a mixed performance with Jersey making a small gain, the Isle of Man moving up but Guernsey dropping 15 places in the index to 75th place.

Mark Yeandle, Director of Z/Yen and the author of the GFCI, said: "London remains second despite many people predicting that it may fall further. New York is still at the top for now but Hong Kong, Singapore and Shanghai are closing in fast.”

10 March 2019

IMF Executive Board Reviews Corporate Taxation in the Global Economy

On February 21, 2019, the Executive Board of the International Monetary Fund (IMF) discussed a paper setting out the current state of international corporate income tax arrangements.

The policy paper Corporate Taxation in The Global Economy, explores options that have been suggested for their future development, including several now being considered in global fora and considering the contribution of the Fund to debates and processes now underway.

The IMF is not a standard setting body in this area. Intensive discussions of possible changes to the international tax system are now underway in the Inclusive Framework on Base Erosion and Profit Shifting (BEPS)/the OECD, and the paper is intended to complement that work, reflecting the distinct contribution that the IMF’s broad membership, mandate, expertise and capacity building work position it to make.

The paper builds on an earlier IMF analysis (2014), which stressed the macro-criticality of international corporate tax arrangements, the importance of cross-country spillovers in analyzing corporate tax reform and the particular vulnerability of low income countries to profit shifting activities. The paper discussed on February 21 continues these themes. It provides an update on what has been achieved, an account of remaining challenges, and a high-level overview of key economic aspects and implications of alternative schemes, some of which are now under discussion. Finally, it stresses the importance of fully inclusive cooperation in this area and reflects on the supportive role that the Fund can play in this context.

The paper notes the considerable positive developments achieved since the previous paper was discussed, including the G20/OECD BEPS project and the expansion of the OECD’s body for reaching consensus around these issues to include over 125 countries in the new Inclusive Framework. It notes too, however, that issues remain in continued opportunities for profit shifting, and that concerns regarding tax competition and, more fundamentally, the allocation of taxing rights across countries now underlie much of the discussion within the Inclusive Framework.

The paper does not endorse any specific proposals for international tax reform. It recognizes that views differ widely. Rather the paper identifies and discusses potential criteria by which alternatives might be assessed—with special attention to the circumstances of developing countries—and provides some empirical analysis to support discussions.

The paper stresses the need to maintain and build on the progress in international cooperation on tax matters that has been achieved in recent years, and in some respects now appears under stress. It considers the supportive role that the Fund can play in this context, including by drawing on its capacity building work to inform the standard setting that others lead, and stresses the importance of cooperation among the international organizations active in this area, including through the Platform for Collaboration on Tax.

Executive Board Assessment

Executive Directors welcomed the opportunity to take stock of recent developments in international aspects of corporate taxation, and offered preliminary observations on alternative proposals currently being debated. They acknowledged the importance of these issues to all Fund members in their efforts to raise revenues in an efficient and equitable manner, and the potential for significant cross‑border spillovers.

Directors welcomed the significant progress made in addressing corporate tax avoidance and enhancing multilateral cooperation, notably by the G‑20/OECD project on Base Erosion and Profit Shifting, and the Inclusive Framework that has broadened the scope of cooperation to many non‑OECD countries. At the same time, they noted that there remain shortcomings in current international tax arrangements, and that many countries face pressures to introduce unilateral action. Directors agreed that much remains to be done to find sustainable global solutions, building on the progress achieved so far to ensure fairness, inclusiveness, and broad consensus, although their views differed on the extent of needed reforms and the roles of relevant bodies.

As an important element of the current debate, Directors welcomed the discussion on tax challenges associated with digitalization. They recognized that this is a difficult issue, technically and politically, and that views on whether special treatment is needed, and if so in what form, continue to differ widely. For the long term, a number of Directors considered that it would not be desirable or feasible to design ring‑fenced solutions. Directors looked forward to the final report from the OECD to the G‑20 in 2020, which could serve as a basis for a cooperative approach going forward.

Directors noted other challenges that have yet to be fully addressed. They welcomed the emphasis in the paper on profit shifting, which is a particular concern for developing countries. They also pointed to the damage from continued harmful tax competition, including the risk of a race to the bottom, while recognizing the importance of respecting national sovereignty in tax matters. Some Directors were of the view that the benefits of fair tax competition should also be acknowledged.

Directors noted that views on the relative merits of alternative reform proposals vary to a great extent. They emphasized that much depends not only on the detail of specific proposals and their implementation but also on the relative importance attached to the various assessment criteria. Noting the tentative nature of the staff assessment, Directors stressed that it should be interpreted and communicated with caution. While Directors considered it too early to endorse any of the particular alternatives, they found the discussion a useful analytical complement to existing debates. Specifically, many Directors saw the benefit of minimum taxation in dealing with harmful tax avoidance and profit shifting practices. Directors emphasized that, to better inform the ongoing debate, considerable further analysis of the reform proposals is needed with respect to legal issues, practical consequences, including distributional effects, and implications for various groups of countries with similar or unique characteristics.

Directors underscored the need for an inclusive process for discussing international taxation, especially as fundamental issues in the allocation of taxing rights come under discussion. Many Directors felt that the current governance arrangements, with the OECD as a central body and standard‑setter and supported by the Inclusive Framework, are broadly appropriate. At the same time, many Directors saw room for improvements, including to enhance the representation of developing and low‑income countries in the decision‑making process.

Directors emphasized the important role of the Fund in the area of international corporate taxation, focusing on its universal membership, macroeconomic perspective, and analytical expertise. They stressed in particular the value of Fund advice and extensive capacity building, helping member countries to implement best practices on tax policy and administration. While recognizing that the Fund is not a standard‑setting body in international taxation, they noted that the Fund is well placed to undertake economic analyses of the impact of possible changes, both within and across countries, as well as to ensure that their implications for developing countries are adequately considered. In this context, most Directors advocated a more active role for the Fund in providing analytical contribution, influencing the debate, and fostering broader cooperation. A number of Directors stressed that efforts to bridge data gaps would need to take account of confidentiality issues and limited capacity in many developing countries.

Directors underscored the importance of continued close collaboration with the OECD and other international organizations active in this area, to ensure that the Fund’s work remains complementary to, and avoids duplication of, that of others. They noted that the Platform for Collaboration on Tax provides a useful framework for bringing together the IMF, OECD, UN, and World Bank, and could continue to play an active role in supporting international tax coordination.

IMF Policy Paper: Corporate Taxation in the Global Economy

The policy paper Corporate Taxation in the Global Economy stresses the need to maintain and build on the progress in international cooperation on tax matters that has been achieved in recent years, and in some respects now appears under stress. With special attention to the circumstances of developing countries, the paper identifies and discusses various options currently under discussion for the international tax system to ensure that countries, and in particular low-income countries, can continue to collect corporate tax revenues from multinational activities.

06 March 2019

Mauritius: FSC issues the Financial Services (Custodian services (digital asset)) Rules 2019

The Financial Services (Custodian services (digital asset)) Rules 2019 and the corresponding Financial Services (Consolidated Licensing and Fees) (Amendment) Rules 2019 have come into operation on 01 March 2019.

01 March 2019

Swiss Attorney General Lifts Freeze on Quantum Global Group and its Affiliated Companies’ Bank Accounts

Quantum Global Group (the “Group”) announced today that the Attorney General of Switzerland (the “Swiss AG”) has lifted the freeze on the Group and its affiliated companies’ bank accounts earlier this week after a lengthy investigation into the sources of monies in the bank accounts. As no evidence of any wrongdoing was found, the Swiss AG notified the Group earlier this week that there were no grounds to continue the freeze on the accounts.

The Swiss AG actions follow recent court cases in Switzerland and the proceedings in England, which found in favour of Quantum Global and its Founder, Mr. Jean-Claude Bastos de Morais. These extensive and costly legal proceedings found no evidence of wrong doing by the Group or Mr. Bastos; and clarified that all actions taken by the Group and Mr. Bastos were executed in accordance with commercially valid and legally binding contracts.

The Swiss AG’s decision and the previous rulings in favor of Quantum Global and its Founder highlight and put into further question the unjustified conduct of the Mauritian authorities. The Group reiterates its request that the Mauritian authorities and the Mauritian courts immediately cease all actions against the Group and Mr Bastos, which have prevented the Group from managing its investments in Africa and paying its staff for eleven months. Despite repeated attempts during this period, the affidavit relied upon by the Financial Intelligence Unit (FIU) of Mauritius against Quantum Global is still being withheld from the Group.

Subscribe to:

Posts (Atom)