Four important trends are changing the terms of success in retail banking. Banks need to act now to develop new skills.

28 February 2019

26 February 2019

Statement of the Chairperson of the African Union Commission on the advisory opinion of the International Court of Justice on the process of decolonization of Mauritius

The Chairperson of the African Union Commission, Moussa Faki Mahamat, welcomes the historic Advisory Opinion issued yesterday by the International Court of Justice (ICJ) on the Legal Consequences of the Separation of the Chagos Archipelago from Mauritius in 1965. This Advisory Opinion was delivered in response to a resolution adopted by the United Nations General Assembly on 22 June 2017, at the initiative of the African Group in New York.

The Chairperson of the Commission would like to highlight three key aspects of the ICJ Advisory Opinion:

i) the process of decolonization of Mauritius was not lawfully completed when that country acceded to independence in 1968, following the separation of the Chagos Archipelago;

ii) the United Kingdom is under an obligation to bring to an end its administration of the Chagos Archipelago as rapidly as possible; and

iii) all Member States are under an obligation to cooperation with the United Nations in order to complete the decolonization of Mauritius, given that the right for self-determination is an obligation erga omnes (that applies towards all) which all states have a legal interest to protect.

The Chairperson of the Commission congratulates the people and Government of Mauritius for this milestone in their efforts to complete the decolonization process of their country. He also expresses the gratitude of the African Union to all the countries both within the continent and outside Africa that voted in favour of the United Nations General Assembly resolution and participated in the proceedings before the ICJ in support of the position of Mauritius and the African Union.

The Chairperson of the Commission reaffirms the African Union determination to pursue and intensity its efforts towards the full decolonization of Mauritius, in line with international law. He urges the United Kingdom to end its administration of the Chagos Archipelago as quickly as possible. He calls on all African Union partners to support these efforts, including by emphasizing the imperative for the scrupulous respect of international legality, as reaffirmed by the ICJ in its Advisory Opinion.

The African Union played a critical political and technical role in the process leading to the Advisory Opinion, building on its longstanding position on the issue of the Chagos Archipelago and relevant decisions of its policy organs. The Chairperson takes this opportunity to commend the African Union Legal Team, made up of the Commission’s Office of the Legal Counsel, as well as African counsels and experts for their work throughout this process.

NOTE TO THE EDITORS

About the request to the International Court of Justice (ICJ) to render an Advisory Opinion: Through resolution Assembly/AU/Res.1(XXVIII) adopted at its 28th Ordinary Session held in Addis Ababa, Ethiopia, from 30 to 31 January 2017, the Assembly of Heads of States and Government of the African Union (AU) reaffirmed that the Chagos Archipelago, including Diego Garcia, forms an integral part of the territory of the Republic of Mauritius and that the decolonization of Mauritius will not be complete until it is able to exercise its full sovereignty over the Chagos Archipelago. The Assembly resolved to fully support the action initiated by the Government of the Republic of Mauritius at the level of the United Nations (UN), requesting an Advisory Opinion of the ICJ on the Legal Consequences of the Separation of the Chagos Archipelago from Mauritius.

Following sustained efforts by the African Group in New York, with the support of other countries, the United Nations General Assembly adopted resolution 71/292 (2017), on 22 June 2017, requesting the ICJ to render an Advisory Opinion on the issue at hand.

About the subsequent AU efforts: After the ICJ Order of 14 July 2017, indicating 30 January 2018 as the time-limit within which statements on the question may be presented to the Court, and 16 April 2018 as the time-limit within which States and organizations having presented written statements may submit comments on the other written statements, the Commission, in December 2017, sent a communication to all AU Member States, urging those of them willing to furnish relevant information on the question before the ICJ to submit written statements to the Court by the end of January 2018, in support of the call for the full decolonization of the territory of Mauritius. The Commission also submitted a request to the Court, seeking permission to make a submission in accordance with Article 66 of the ICJ Statute, and established a team of African lawyers from Egypt and Senegal to assist in preparing its submission.

Subsequently, at the request of the AU, the ICJ extended the deadline for making written submissions on the issue of the completion of the decolonization of Mauritius. The new deadline was set for 1 March 2018.

At its 30th Ordinary Session held in Addis Ababa, from 28 to 29 January 2018, the Assembly of Heads of State and Government adopted Decision Assembly/AU/Dec.684(XXX), calling on all Member States, the Regional Economic Communities (RECs), the League of Arab States, the Organization of Islamic Cooperation and all AU partners to make written submissions to the ICJ in support of Mauritius. Given the tight deadline, and in order to ensure a coordinated response, the Commission distributed to Member States a simplified draft statement that could be used for this purpose. It also sent out communications to all RECs and other relevant organizations, to encourage them to submit statements to the ICJ, in order to amplify the position of the AU on this matter.

The AU Commission made its first written statement on 1 March 2018, along with a number of Member States (Djibouti, Lesotho, Madagascar, Mauritius, Namibia, Niger, Nigeria and Seychelles) and other non-African countries. The second AU written comment was submitted to the ICJ in May 2018. In addition, communications were sent to Member States to encourage them to inform the Registrar of the ICJ of their intention to take part in the hearings on the Legal Consequences of the Separation of the Chagos Archipelago from Mauritius.

The Commission, in close collaboration with the Government of Mauritius, engaged Member States to ensure as large African presence as possible at the oral proceedings, which started on 3 September 2018. The ICJ heard pleadings from the Commission and 22 countries, 6 of which were African (Botswana, Kenya, Mauritius, Nigeria, South Africa and Zambia). The majority of the 22 States that attended the pleadings opposed the United Kingdom’s assertion that it has sovereignty over the Archipelago.

The Commission made its oral pleading on 6 September 2018. The AU legal team stressed that the mandate of the Union in establishing African territorial integrity and self-determination stems from its legal instruments and the AU’s contribution to the relevant resolutions of the UN General Assembly. The AU legal team called upon the ICJ to assume its responsibility as the supreme body for international justice, and affirmed that it represented the collective voice of the African continent.

25 February 2019

ICJ: Legal Consequences of the Separation of the Chagos Archipelago from Mauritius in 1965

The International Court of Justice (ICJ) finds that the process of decolonization of Mauritius was not lawfully completed when that country acceded to independence and that the United Kingdom is under an obligation to bring to an end its administration of the Chagos Archipelago as rapidly as possible.

DPP: COMMUNIQUE ON THE PRIVY COUNCIL DECISION IN THE MEDPOINT CASE

The Judicial Committee of the Privy Council has today delivered its judgment in the appeal of DPP v Pravind Kumar Jugnauth [2019] UKPC 8. The Office of the Director of Public Prosecutions welcomes the decision of the Privy Council as it sheds light on matters which were up to now in controversy.

In a Communiqué issued by this Office on 08 June 2016, we explained our decision to appeal to the Privy Council. Our Office was of the view that the judgment of the Supreme Court gave rise to important questions, crucial to establishing an offence under section 13(2) of the Prevention of Corruption Act (the POCA), in particular –

(a) the requisite degree of knowledge and criminal intent of a public official to establish an offence of Conflict of Interests, and whether good faith can be invoked as a defence;

(b) the meaning of the term “personal interest” and whether it excludes the shareholding of the relative of a public official in a company;

(c) the nature of participation in proceedings prohibited under that provision and whether a public official is precluded from taking any step in the execution of a contract which has been awarded by a public body to a company in which a relative of that public official has shares.

In granting leave to appeal to the Privy Council, the Supreme Court agreed that the matters referred to above raised substantial and significant issues of law of great general or public importance which ought to be submitted to the Privy Council for determination.

We note that the Privy Council in its judgment has accepted our position on the points of law in issue in this case and has confirmed the legal reasoning adopted by the Intermediate Court. However, it has also found that on the facts of the present case, payment to Medpoint would have been effected irrespective of the re-allocation of funds and, therefore, Mrs Malhotra had no personal interest within the meaning of section 13(2) of the POCA.

The judgment of the Privy Council will undoubtedly be of valuable assistance to our Office when deciding future cases under section 13(2) of the POCA.

Office of the Director of Public Prosecutions

25 February 2019

20 February 2019

International Investment: Fintech - How Technology Is Shaping The Future Of International Financial Services

International Investment's latest special report on Fintech and the future of international financial services is out now.

19 February 2019

KitKat Green Tea Matcha brings flavour of Japan to Europe

Nestlé will bring the flavour of Japan to Europe this spring with the KitKat Green Tea Matcha.

The four-finger treat will be available in retailers across Europe starting in late February. This follows requests from chocolate lovers to make innovative KitKat flavours available to consumers outside Japan.

KitKat Green Tea Matcha is inspired by one of the most popular of the 350+ KitKat varieties that have been available in Japan over the years. The brand is a household name there, popular for gifting and with tourists looking for an interesting souvenir.

Matcha is a traditional drink made from powdered green tea that has been enjoyed for centuries in Japan, often as part of an elaborate tea ceremony. In KitKat Green Tea Matcha, it is combined with smooth white chocolate to give a sweet and fragrant flavour.

“From its origins in the United Kingdom in 1935, KitKat has grown in popularity across the globe. Nestlé in Japan has taken KitKat to the next level in the last two decades, with innovative flavour combinations and inspiring special editions. We are excited to bring one of the most iconic Japanese KitKats back home to Europe this year,” said Alexander von Maillot, Global Head of Confectionery at Nestlé.

KitKat Green Tea Matcha for the European market is manufactured in Hamburg, Germany using UTZ-certified cocoa beans and real Matcha green tea from Japan and China. There are no artificial colours, flavours or preservatives.

The new launch follows on from the introduction of KitKat Ruby in Europe in 2018, to meet the growing demands of consumers who enjoy experimenting with new trends.

Alexander von Maillot added: “The launches of KitKat Ruby and KitKat Green Tea Matcha are further proof of our commitment to our leading international confectionery brand. We have introduced other innovative flavours and premium products to KitKat, KitKat Chunky and KitKat Senses in recent years, and there is more to come!”

The rise of KitKat in Japan began in the year 2000 with a strawberry flavour version. In 2004, the ‘KitKat Uji Matcha’ was released. With the introduction of a new technology to mix matcha powder into chocolate, the product became a huge hit.

16 February 2019

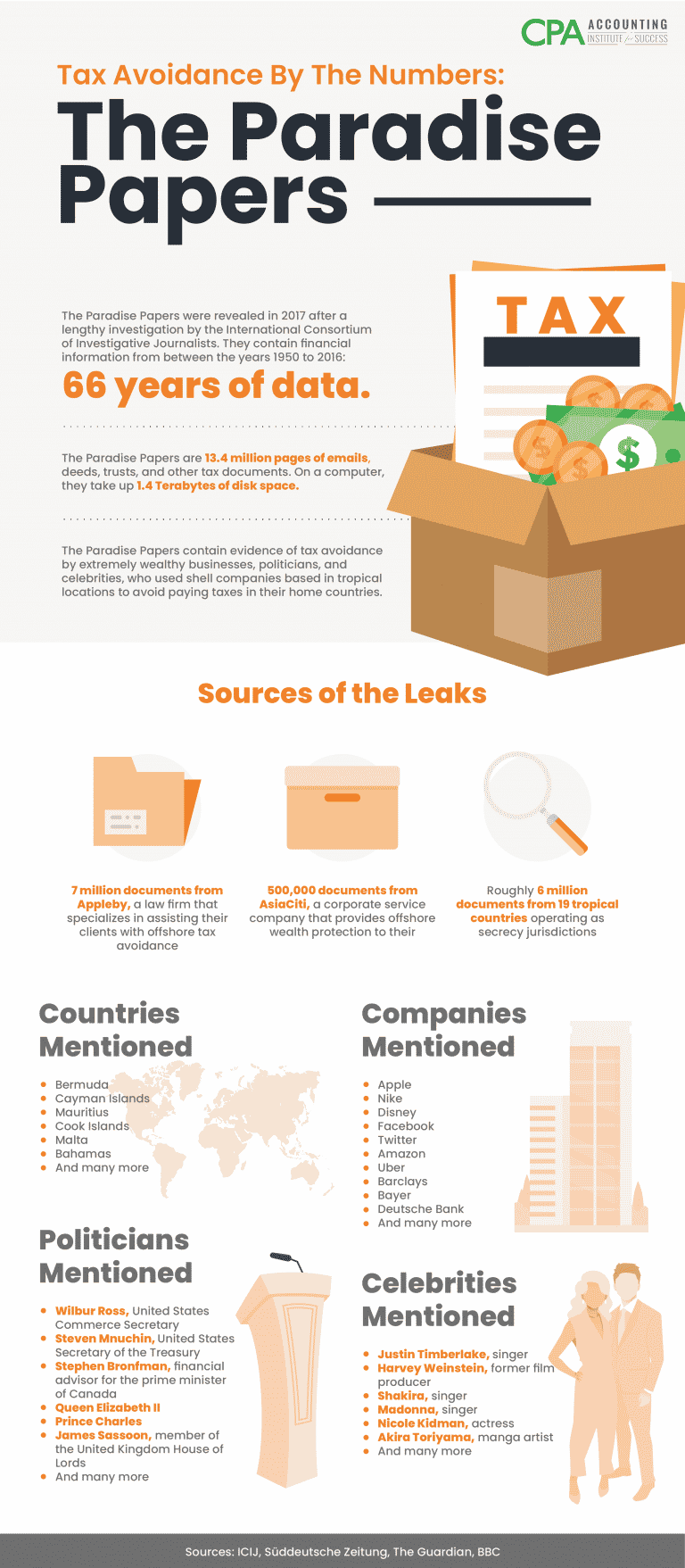

Tax Avoidance By The Numbers: The Paradise Papers

Here’s a quick riddle for you: what do Donald Trump’s son-in-law, Shakira, and Queen Elizabeth II have in common?

All of them are mentioned in the Paradise Papers!

This 1.4-Terabyte treasure trove of financial documents contains details about some of the world’s wealthiest people. The list of hundreds of people whose confidential transactions have been revealed by the Paradise Papers includes politicians, business tycoons, entertainment and sports stars, and some of the largest companies on Earth.

The 13.4 million pages that comprise these leaked documents reveal how the world’s rich escape the tax laws of their home countries by using offshore tax havens. It’s more or less a mega-compendium on all things tax avoidance. For that reason, I think it’s an excellent educational resource to any aspiring tax professionals who want to know more about how the global tax system works and the numerous ways people exploit it.

Keep reading to learn more about what the Paradise Papers are all about and what they can teach us about tax avoidance!

14 February 2019

IMF - FinTech in Sub-Saharan African Countries : A Game Changer?

FinTech is a major force shaping the structure of the financial industry in sub-Saharan Africa. New technologies are being developed and implemented in sub-Saharan Africa with the potential to change the competitive landscape in the financial industry. While it raises concerns on the emergence of vulnerabilities, FinTech challenges traditional structures and creates efficiency gains by opening up the financial services value chain. Today, FinTech is emerging as a technological enabler in the region, improving financial inclusion and serving as a catalyst for the emergence of innovations in other sectors, such as agriculture and infrastructure.

Daily Maverick - How to invest offshore

Given the compelling reasons for investing offshore, which include diversification benefits, reduced emerging market and currency risk, and maintenance of ‘hard’ currency spending power, how best should investors go about investing offshore?

13 February 2019

AON 2019 Cyber Security Risk Report: What’s Now and What’s Next

Aon plc, the leading global professional services firm providing a broad range of risk, retirement and health solutions, released its 2019 Cyber Security Risk Report today. The report, which details the greatest cyber security threats and challenges organizations are currently facing, discusses that as companies continue to use technology to speed up the transfer of information, game-changing business opportunities are created, as well as increased cyber risk.

"In 2018 we witnessed that a proactive approach to cyber preparation and planning paid off for the companies that invested in it, and in 2019, we anticipate the need for advanced planning will only further accelerate," said J. Hogg, CEO of Cyber Solutions at Aon. "Leaders must work to better insulate their companies and their processes, while simultaneously identifying the ways they can benefit from the opportunities offered through technology and digital transformation."

Hogg continued: "Our 2019 report also shows that organizations must recognize the need to share threat intelligence across not only their own network but with others as well. While it may seem counterintuitive when thinking about cyber security, collaboration within and across enterprises and industries can keep private data of companies and individuals alike safer. Working together can result in improved efforts to hunt bad actors, while also raising the bar and making all parties more prepared for the inevitable day when a disruption does happen."

The "What's Now and What's Next" report focuses on eight specific risk areas that companies may face in 2019. The risks illustrate how, as organizations transition to a digital-first approach across all transactions, the attack surface of global business expands rapidly and sometimes in unexpected ways. In other words, thanks to the rapid enhancements and constant changes in technology, the number of touch points that cyber criminals can access within a business is growing exponentially.

Highlights from the report include:

- Technology – While technology has revolutionized the way organizations today conduct business, broader and wider-spread use of technology also brings vulnerabilities. From publishing to automotive, industries are facing new, evolving services and business models. These new opportunities however, bring with them a radically different set of risks, which organizations will need to anticipate and manage as they continue the digital transformation process.

- Supply Chain – Two prevailing supply chain trends will heighten cyber risks dramatically in the coming year: one is the rapid expansion of operational data exposed to cyber adversaries, from mobile and edge devices like the Internet of Things (IoT); and the other trend is companies' growing reliance on third-party—and even fourth-party—vendors and service providers. Both trends present attackers with new openings into supply chains, and require board-level, forward-looking risk management in order to sustain reliable and viable business operations.

- IoT – IoT devices are everywhere, and every device in a workplace now presents a potential security risk. Many companies don't securely manage or even inventory all IoT devices that touch their business, which is already resulting in breaches. As time goes on, the number of IoT endpoints will increase dramatically, facilitated by the current worldwide rollouts of cellular IoT and the forthcoming transition to 5G. Effective organizational inventory and monitoring process implementation will be critical for companies in the coming year and beyond.

- Business Operations – Connectivity to the Internet improves operational tasks dramatically, but increased connectivity also leads to new security vulnerabilities. The attack surface expands greatly as connectivity increases, making it easier for attackers to move laterally across an entire network. Further, operational shortcuts or ineffective backup processes can make the impact of an attack on business operations even more significant. Organizations need to be better aware of, and prepared for, the cyber impact of increased connectivity.

- Employees – Employees remain one of the most common causes of breaches. Yet employees likely do not even realize the true threat they pose to an entire organization's cyber security. As technology continues to impact every job function, from the CEO to the entry-level intern, it is imperative for organizations to establish a comprehensive approach to mitigate insider risks, including strong data governance, communicating cyber security policies throughout the organization, and implementing effective access and data-protection controls.

- Mergers & Acquisitions (M&A) – Projections anticipate that M&A deal value will top $4 trillion in 2018, which would be the highest in four years [1]. The conundrum this poses to companies acquiring other businesses is that while they may have a flawless approach to cyber security enterprise risk, there is no guarantee that their M&A target has the same approach in place. Dealmakers must weave specific cyber security strategies into their larger M&A plans if they want to ensure seamless transitions in the future.

- Regulatory – Increased regulation, laws, rules and standards related to cyber are designed to protect and insulate businesses and their customers. The pace of cyber regulation enforcement increased in 2018, setting the stage for heightened compliance risk in 2019. Regulation and compliance, however, cannot become the sole focus. Firms must balance both new regulations and evolving cyber threats, which will require vigilance on all sides.

- Board of Directors – Cyber security oversight continues to be a point of emphasis for board directors and officers, but recent history has seen an expanding personal risk raising the stakes. Boards must continue to expand their focus and set a strong tone across the company, not only for actions taken after a cyber incident, but also proactive preparation and planning.

Learn more about the risks included in Aon's 2019 Cyber Security Risk Report.

European Commission adopts new list of third countries with weak anti-money laundering and terrorist financing regimes

The aim of this list is to protect the EU financial system by better preventing money laundering and terrorist financing risks. As a result of the listing, banks and other entities covered by EU anti-money laundering rules will be required to apply increased checks (due diligence) on financial operations involving customers and financial institutions from these high-risk third countries to better identify any suspicious money flows. On the basis of a new methodology, which reflects the stricter criteria of the 5th anti-money laundering directive in force since July 2018, the list has been established following an in-depth analysis.

Věra Jourová, Commissioner for Justice, Consumers and Gender Equality said: “We have established the strongest anti-money laundering standards in the world, but we have to make sure that dirty money from other countries does not find its way to our financial system. Dirty money is the lifeblood of organised crime and terrorism. I invite the countries listed to remedy their deficiencies swiftly. The Commission stands ready to work closely with them to address these issues in our mutual interest."

The Commission is mandated to carry out an autonomous assessment and identify the high-risk third countries under the Fourth and Fifth Anti-Money Laundering Directives.

The list has been established on the basis of an analysis of 54 priority jurisdictions, which was prepared by the Commission in consultation with the Member States and made public on 13 November 2018. The countries assessed meet at least one of the following criteria:

- they have systemic impact on the integrity of the EU financial system,

- they are reviewed by the International Monetary Fund as international offshore financial centres;

- they have economic relevance and strong economic ties with the EU.

For each country, the Commission assessed the level of existing threat, the legal framework and controls put in place to prevent money laundering and terrorist financing risks and their effective implementation. The Commission also took into account the work of the Financial Action Task Force (FATF), the international standard-setter in this field.

The Commission concluded that 23 countries have strategic deficiencies in their anti-money laundering/ counter terrorist financing regimes. This includes 12 countries listed by the Financial Action Task Force and 11 additional jurisdictions. Some of the countries listed today are already on the current EU list, which includes 16 countries.

Next steps

The Commission adopted the list in the form of a Delegated Regulation. It will now be submitted to the European Parliament and Council for approval within one month (with a possible one-month extension). Once approved, the Delegated Regulation will be published in the Official Journal and will enter into force 20 days after its publication.

The Commission will continue its engagement with the countries identified as having strategic deficiencies in the present Delegated Regulation and will further engage especially on the delisting criteria. This list enables the countries concerned to better identify the areas for improvement in order to pave the way for a possible delisting once strategic deficiencies are addressed.

The Commission will follow up on progress made by listed countries, continue monitoring those reviewed and start assessing additional countries, in line with its published methodology. The Commission will update this list accordingly. It will also reflect on further strengthening its methodology where needed in light of experience gained, with a view to ensuring effective identification of high-risk third countries and the necessary follow-up.

Background

The fight against money laundering and terrorist financing is a priority for the Juncker Commission. The adoption of the Fourth – in force since June 2015- and the Fifth Anti-Money Laundering Directives – in force since 9 July 2018 - has considerably strengthened the EU regulatory framework.

Following the entry into force of the Fourth Anti-Money Laundering Directive in 2015, the Commission published a first EU list of high-risk third countries based on the assessment of the Financial Action Task Force. The Fifth Anti-Money Laundering Directive broadened the criteria for the identification of high-risk third countries, including notably the availability of information on the beneficial owners of companies and legal arrangements. This will help better address risks stemming from the setting up of shell companies and opaque structures which may be used by criminals and terrorists to hide the real beneficiaries of a transaction (including for tax evasion purposes). The Commission developed its own methodology to identify high-risk countries, which relies on information from the Financial Action Task Force, complemented by its own expertise and other sources such as Europol. The result is a more ambitious approach for identifying countries with deficiencies posing risks to the EU financial system. The decision to list any previously unlisted country reflects the current assessment of the risks in accordance with the new methodology. It does not mean the situation has deteriorated since the list was last updated.

The new list published today replaces the one currently in place since July 2018.

ANNEX

The 23 jurisdictions are:

(1) Afghanistan,

(2) American Samoa,

(3) The Bahamas,

(4) Botswana,

(5) Democratic People's Republic of Korea,

(6) Ethiopia,

(7) Ghana,

(8) Guam,

(9) Iran,

(10) Iraq,

(11) Libya,

(12) Nigeria,

(13) Pakistan,

(14) Panama,

(15) Puerto Rico,

(16) Samoa,

(17) Saudi Arabia,

(18) Sri Lanka,

(19) Syria,

(20) Trinidad and Tobago,

(21) Tunisia,

(22) US Virgin Islands,

(23) Yemen.

12 February 2019

Scam Alert: The Financial Services Commission, Mauritius (the FSC Mauritius) warns its licensees against phishing and scam emails

The FSC Mauritius wishes to caution all its licensees against phishing and scam emails requesting transfer of clients’ monies.

Licensees are hereby informed that these requests are fraudulent in nature and are being called upon to exercise extra care and diligence when dealing with clients’ accounts.

Licensees are being requested to report any incident of such nature to local enforcement agencies.

12 February 2019

08 February 2019

Mauritius: FSC Communiqué in relation to the Regulatory Framework for the Custodian Services (Digital Asset) Licence

Further to the report of the Regulatory Committee on FinTech and Innovation-Driven Financial Services, the Financial Services Commission (the “FSC”) has made significant progress in establishing the Mauritius International Financial Centre (the “Mauritius IFC”) as the FinTech hub, in and for, Africa.

Following the recognition of Digital Assets as an asset-class for investment by Sophisticated and Expert Investors on 17 September 2018, the FSC issued, on 05 November 2018, a Consultation Paper seeking feedback from stakeholders and the public on the proposed regulatory framework for the Custodian Services (Digital Asset) Licence, which allows its holder to provide custody services for Digital Assets.

This regulatory framework will be effective as from 01 March 2019, positioning the Mauritius IFC as the first jurisdiction globally to offer a regulated landscape for the custody of Digital Assets. Holders of the Custodian Services (Digital Asset) Licence will equally have to comply with the applicable framework for AML/CFT in line with international best practices.

Commenting on this avant-garde supervisory infrastructure, the Honourable Pravind Kumar Jugnauth, Prime Minister of the Republic of Mauritius stated that “In revolutionising the global FinTech ecosystem through this regulatory framework for the custody of Digital Assets, my Government reiterates its commitment to accelerating the country’s move to an age of digitally-enabled economic growth. As an African country, we look forward to fostering further innovation and bringing more prosperity to the region.”

According to the Chairman of the FSC, Dr Renganaden Padayachy “The Blueprint has identified a number of key opportunities that we have to tap into to foster further valueadded activities in our jurisdiction. This new framework is in line with this strategy and we are confident that it is yet another addition that will increase the competitiveness of our jurisdiction.”

The Chief Executive of the FSC, Mr Harvesh Seegolam expressed that “The FSC is committed to implementing enabling frameworks which facilitate the development of the Mauritius IFC. We continue to collaborate with our international counterparts and stakeholders in introducing the appropriate regulatory mechanisms. I wish to put on record the active participation of all parties during the consultation phase preceding the introduction of this revolutionary structure for our jurisdiction.”

The FSC has participated fully in discussions at the level of the Organisation for Economic Cooperation and Development (OECD) on the governance and regulation of Digital Financial Assets, and the regulatory framework for the Custodian Services (Digital Asset) Licence has been developed in reference to these international consultations.

Mauritius: Partial Exemption regime introduced by Finance Act 2018

The Ministry of Finance and Economic Development held a meeting today with concerned stakeholders of the Financial Services industry on the findings of the Code of Conduct Group of the European Union further to its assessment of the Partial Exemption regime.

06 February 2019

Offshore Havens, Secrecy and Due Process of Law

When the story about Panama Leaks became a major headline news across the world in 2016, all hell broke loose in Pakistan too. More than 400 Pakistani nationals were identified as owning properties in offshore havens even though the value of those properties/funds may only constitute a minuscule proportion of the estimated $16 trillion—a staggering figure even though considered to be a conservative estimate by many pundits and bankers—held in offshore jurisdictions.

EU Council Code of Conduct Group (Business Taxation): Replacement of Mauritius' harmful preferential tax regime(s) with measures of similar effect

05 February 2019

Mauritius: Financial Services (Global Business Corporations) Rules 2019

Financial Services (Global Business Corporations) Rules 2009

Subscribe to:

Posts (Atom)