30 July 2019

Science: Pesticide Planet - Pesticide use on arable land between 2005 – 2009

In a world of humanmade chemicals, pesticides are second only to fertilizer in the amount applied and the extent of use. They are effective tools for protecting crops, fighting disease-causing insects and dealing with nuisance animals such as rodents, fleas and ticks. But herbicides, insecticides and their kin can harm the environment and are dangerous to workers if improperly used.

29 July 2019

Oxfam: 5 steps governments can take to prevent another Mauritius Leaks scandal

A 5-point plan to stop big corporations cheating poor countries out of billions of dollars in tax revenue, was published by Oxfam today in the wake of the Mauritius Leaks.

When multinational corporations and the super-rich use tax havens to dodge paying their fair share, it is ordinary people, and especially the poorest, who pay the price. The Mauritius Leaks show that tax havens continue not only to exist but to prosper, despite government promises to rein in tax dodging. Oxfam’s plan lists five steps governments can take to tackle tax avoidance and end the era of tax havens.

Susana Ruiz, Oxfam International’s tax advisor, said:

“Politicians could put a stop to tax scandals if they wanted to. Oxfam has listed 5 concrete solutions that would prevent another Mauritius Leaks scandal and ensure multinational corporations pay their fair share of tax wherever they do business. Developing countries can revise or void their tax treaties and introduce withholding taxes to better protect their tax revenue, and all governments – rich and poor – agree to set a global minimum effective tax rate on corporate profits.

“There is no time to waste. Developing countries lose an estimated $100 billion a year in tax revenue as a result of tax dodging by multinational corporations, and even more as a result of damaging tax competition between countries. This money is desperately needed to end hunger, tackle the climate crisis, and ensure all children have the chance of an education.”

Oxfam’s 5-point plan to build a fairer global tax system calls on governments to:

(1) Agree new global tax rules in the negotiations led by the OECD under the mandate of the G20 to ensure fair taxation of big corporations. This should include the introduction of a global minimum effective tax rate set at an ambitious level and applied at a country-by-country basis without exception. This would put a stop to the damaging tax competition between countries and remove the incentive for profit shifting – effectively putting tax havens out of business.

(2) Developing countries should not give away their taxing rights. Many treaties result in multinational companies not paying certain types of tax at all in any country. Rich countries have a responsibility in ensuring fair taxation with their investments and the projects they finance. Governments of developing countries can protect their tax base from erosion by revising or voiding their tax treaties, introducing withholding taxes and implementing strong tax anti-abuse rules.

(3) End corporate tax secrecy by ensuring all multinational companies publish financial reports for every country where they operate. The current OECD initiative on country-by-country reporting falls well short of the mark as it does not cover all multinational corporations and it does not require companies to make their financial reports publicly available. This means poor countries are unable to access the information to identify tax cheats. Stronger European proposals on public country-by-country reporting were due to be agreed this year but are being blocked by EU member states such as Germany, Ireland, and Luxembourg.

(4) Agree a global blacklist of tax havens based on comprehensive objective criteria and take strong countermeasures including sanctions to limit their use. Governments have yet to agree an objective global list of tax havens. A farcical OECD-G20 blacklist published in July 2017 features only Trinidad and Tobago. The more comprehensive European Union list omits European tax havens such as the Netherlands and Ireland.

(5) Strengthen global tax governance by creating a global tax body where all countries can work together on an equal footing to ensure the tax system works for everyone. The new round of global tax negotiations (BEPS 2.0) is a historic opportunity to put a stop to damaging tax competition and corporate tax avoidance, and to build a fairer tax system that works for the benefit of all people and not just a fortunate few. Even if the new round of global tax negotiations (BEPS 2.0) delivers positive results, a more inclusive tax body is required to oversee the global governance of international tax matters and strengthen international tax cooperation.

Endless Corporate Tax Scandals? 5-point plan to build a fairer global tax system

When multinational corporations and the super-rich use tax havens to avoid paying their fair share, it is ordinary people, and especially the poorest, who pay the price. The Mauritius Leaks show that tax havens continue not only to exist but to prosper, despite government promises to rein in tax dodging. This briefing lists five steps governments can take to tackle tax avoidance, and end the era of tax havens and the race to the bottom on corporate taxation.

28 July 2019

Oxfam: Buried Treasure – Aussie mining companies behaving badly in West Africa

From the air Ayanfuri, a small cocoa farming township in central Ghana, looks like it’s being slowly dragged into a huge open-pit gold mine.

For the last seven years the Edikan Gold Mine, owned by Australian mining company Perseus, has been clearing family owned cocoa plantations and relocating communities, markets and schools as the mine has continued to grow.

Whilst mining companies like Perseus are extracting precious and finite resources from Ghana, it is unclear if any of the wealth is benefiting the local community and the country as a whole.

In February this year Oxfam Australia visited Ayanfuri with Oxfam Ghana staff and the Africa Centre for Energy Policy to research our new report, Buried Treasure. This report details how Australian mining companies are hiding their wealth and avoiding paying their fair share of taxes in some of the poorest countries on earth, tax revenue that is urgently needed for public services like schools and hospitals.

We estimate that in 2015 Australian mining companies funnelled over $1 billion in profits out of Africa through the use of tax havens. That’s over $300 million that should have been paid in taxes to the governments in the poorest region in the world.

In Ayanfuri the impact of the missing money is immediate.

Like many towns across Ghana Ayanfuri is starved of public services and infrastructure like schools, health clinics and sanitation. Lack of access to basic services are trapping people in poverty.

We visited Ayanfuri to meet the community members who are filling this gap themselves and fighting for change. Whether it’s keeping the schools open with limited resources, working overtime in health clinics or advocating for better small business opportunities– the Ayanfuri community carries a responsibility that should be better shared by the government through taxes paid by the mine. And yet, after six years of extracting gold, Perseus hasn’t paid a single dollar of tax to the Government of Ghana. The gold won’t be there forever – once it is all dug up – the community will be left in a state that is likely worse off than before the mine started. Perseus should be paying taxes to the Government of Ghana to allow the government to invest in the future of Ayanfuri.

The local market place is the heart of Ayanfuri and the women that work there have watched how the town has changed since the arrival of the gold mine. Afia Dede, who has worked at the market for 26 years told us that 70% of the town are struggling with unemployment and they see little support from the mine or the government. When Perseus relocated a portion of the town and the market for the mine, Afia found herself in substantial debt for the construction of her new home – a responsibility she should not have had to shoulder. These debt repayments keep Afia’s family in poverty even while she tries to grow her business and support her family. The new marketplace isn’t sheltered, despite promises from mine to build a roof over it. Afia told us that in the open the rain regularly spoils their investments.

At the local school Job Nyarko told us of his dreams to have enough desks, books and other basic resources for his students. The school has more than 600 children – Job told us that each class has 50-plus students working with about 20 textbooks, and up to four students sharing a small bench and table that doesn’t give them enough room to write. These are basic things that the Government of Ghana could better afford if more tax was paid and collected from some of the big mining companies that operate across the nation.

Kobe is the head nurse at the Pentecost health Centre, the only medical facility in the community. With only one doctor and a small team of nurses the demand for health outstripped the clinics resources a long time ago. The hospital needs three times the number of staff, Kobe told us. Without an operating theatre or anaesthetist, people are forced to travel long distances to find care. The lack of public transport makes the trip prohibitively expensive and many community members are forced to go untreated.

The squeeze on resources has the biggest impact on women and kids. A lack of medical staff, education opportunities and public transport means many women in Ayanfuri go untreated for a range of pregnancy and birth related complications including ectopic pregnancies, preeclampsia and severe complications from home births. The clinic regularly deals with diarrhoea cases, especially in children due to a deterioration in the quality of the local drinking water in the last few years. Water borne sickness keeps kids from school and, as every trip to a private clinic puts further financial pressure on families, the family spirals into further poverty.

Tax avoidance is a global problem and no country is immune. Closing tax loopholes that allow multinationals to get away with not paying their fair share of taxes has a real, tangible impact on people’s lives. In Ayanfuri we estimate that the Ghanaian government has lost up to $57 million in tax revenue since the mine started operating in 2012 – enough to pay the salary of 8000 nurses.

When Australian mining companies like Perseus pay taxes it means girls get to stay in school and women get proper prenatal care.

23 July 2019

IBM Study Shows Data Breach Costs on the Rise; Financial Impact Felt for Years

Security today announced the results of its annual study examining the financial impact of data breaches on organizations. According to the report, the cost of a data breach has risen 12% over the past 5 years and now costs $3.92 million on average. These rising expenses are representative of the multiyear financial impact of breaches, increased regulation and the complex process of resolving criminal attacks.

The financial consequences of a data breach can be particularly acute for small and midsize businesses. In the study, companies with less than 500 employees suffered losses of more than $2.5 million on average – a potentially crippling amount for small businesses, which typically earn $50 million or less in annual revenue.

For the first time this year, the report also examined the longtail financial impact of a data breach, finding that the effects of a data breach are felt for years. While an average of 67% of data breach costs were realized within the first year after a breach, 22% accrued in the second year and another 11% accumulated more than two years after a breach. The longtail costs were higher in the second and third years for organizations in highly-regulated environments, such as healthcare, financial services, energy and pharmaceuticals.

"Cybercrime represents big money for cybercriminals, and unfortunately that equates to significant losses for businesses," said Wendi Whitmore, Global Lead for IBM X-Force Incident Response and Intelligence Services. "With organizations facing the loss or theft of over 11.7 billion records in the past 3 years alone, companies need to be aware of the full financial impact that a data breach can have on their bottom line –and focus on how they can reduce these costs."

Sponsored by IBM Security and conducted by the Ponemon Institute, the annual Cost of a Data Breach Report is based on in-depth interviews with more than 500 companies around the world that suffered a breach over the past year. The analysis takes into account hundreds of cost factors including legal, regulatory and technical activities to loss of brand equity, customers, and employee productivity. Some of the top findings from this year's report include:

- Malicious Breaches – Most Common, Most Expensive: Over 50% of data breaches in the study resulted from malicious cyberattacks and cost companies $1 million more on average than those originating from accidental causes.

- "Mega Breaches" Lead to Mega Losses: While less common, breaches of more than 1 million records cost companies a projected $42 million in losses; and those of 50 million records are projected to cost companies $388 million.

- Practice Makes Perfect: Companies with an incident response team that also extensively tested their incident response plan experienced $1.23 million less in data breach costs on average than those that had neither measure in place.

- U.S. Breaches Cost Double: The average cost of a breach in the U.S. is $8.19 million, more than double the worldwide average.

- Healthcare Breaches Cost the Most: For the 9th year in a row, healthcare organizations had the highest cost of a breach – nearly $6.5 million on average (over 60% more than other industries in the study).

The study found that data breaches which originated from a malicious cyberattack were not only the most common root cause of a breach, but also the most expensive.

Malicious data breaches cost companies in the study $4.45 million on average – over $1 million more than those originating from accidental causes such as system glitch and human error. These breaches are a growing threat, as the percentage of malicious or criminal attacks as the root cause of data breaches in the report crept up from 42% to 51% over the past six years of the study (a 21% increase).

That said, inadvertent breaches from human error and system glitches were still the cause for nearly half (49%) of the data breaches in the report, costing companies $3.50 and $3.24 million respectively. These breaches from human and machine error represent an opportunity for improvement, which can be addressed through security awareness training for staff, technology investments, and testing services to identify accidental breaches early on. One particular area of concern is the misconfiguration of cloud servers, which contributed to the exposure of 990 million records in 2018, representing 43% of all lost records for the year according to the IBM X-Force Threat Intelligence Index.

Breach Response Remains Biggest Cost Saver

For the past 14 years, the Ponemon Institute has examined factors that increase or reduce the cost of a breach and has found that the speed and efficiency at which a company responds to a breach has a significant impact on the overall cost.

This year's report found that the average lifecycle of a breach was 279 days with companies taking 206 days to first identify a breach after it occurs and an additional 73 days to contain the breach. However, companies in the study who were able to detect and contain a breach in less than 200 days spent $1.2 million less on the total cost of a breach.

A focus on incident response can help reduce the time it takes companies to respond, and the study found that these measures also had a direct correlation with overall costs. Having an incident response team in place and extensive testing of incident response plans were two of the top three greatest cost saving factors examined in the study. Companies that had both of these measures in place had $1.23 million less total costs for a data breach on average than those that had neither measure in place ($3.51 million vs. $4.74 million).

Additional factors impacting the cost of a breach for companies in the study included:

- Number of compromised records: Data breaches cost companies around $150 per record that was lost or stolen.

- Companies that fully deployed security automation technologies experienced around half the cost of a breach ($2.65 million average) compared to those that did not have these technologies deployed ($5.16 million average).

- Extensive use of encryption was also a top cost saving factor, reducing the total cost of a breach by $360,000.

- Breaches originating from a third party – such as a partner or supplier – cost companies $370,000 more than average, emphasizing the need for companies to closely vet the security of the companies they do business with, align security standards, and actively monitor third-party access.

Regional and Industry Trends

The study also examined the cost of data breaches in different industries and regions, finding that data breaches in the U.S. are vastly more expensive – costing $8.19 million, or more than double the average for worldwide companies in the study. Costs for data breaches in the U.S. increased by 130% over the past 14 years of the study; up from $3.54 million in the 2006 study.

Additionally, organizations in the Middle East reported the highest average number of breached records with nearly 40,000 breached records per incident (compared to global average of around 25,500.)

For the 9th year in a row, healthcare organizations in the study had the highest costs associated with data breaches. The average cost of a breach in the healthcare industry was nearly $6.5 million - over 60% higher than the cross-industry average.

Oxfam: Mauritius Leaks reveal Africa is losing crucial tax revenues to tax haven of Mauritius

Responding to research published by the International Consortium of Investigative Journalists today that multinational corporations are using the tax haven of Mauritius to avoid paying millions of dollars of tax across Africa, Peter Kamalingin, Oxfam’s Pan Africa Director, said:

“Mauritius Leaks provide yet another example of how multinational corporations are gaming the system to shrink their tax bills – and cheating some of the world’s poorest countries out of the vital tax revenues they need to get children into school or ensure people can see a doctor when they are ill.

“The true scandal is that this – like most tax avoidance schemes – is completely legal. Real political will is needed urgently to rewrite global tax rules and introduce a global minimum effective tax rate that is paid by all multinational corporations no matter where they are based. This would put a stop to the damaging tax competition between countries and remove the incentive for profit shifting – effectively putting tax havens like Mauritius out of business.

‘'African governments should revise their tax policies with Mauritius and other tax havens and defend their tax revenues better. Countries do not need to wait for global action, unilateral action is possible.’'

Notes

Mauritius Leaks revealed that multinational corporations artificially but legally shifted their profits out of African countries where they do business to the corporate tax haven of Mauritius, where foreign income like interest payments are taxed at the very low rate of 3 percent. Unfair tax agreements signed between Mauritius and countries in Africa and Europe allow some companies to cut their tax bills even further.

Mauritius Leaks is a global investigation by the International Consortium of Investigative Journalists (ICIJ). For more details see: https://www.icij.org/investigations/mauritius-leaks/

Since 2014, a huge number of documents, including the Panama Papers and Paradise Papers scandals, have been leaked by ICIJ unveiling how tax evasion and avoidance have become standard business practice across the globe.

Countries from across the globe, including several African countries, are currently participating in a round of international tax negotiations under the OECD-G20 umbrella, including issues such as the introduction of a global minimum effective tax rate. To effectively curb profit shifting, countries must ensure the global minimum effective tax rate is set at an ambitious level and applied at a country-by-country basis without exceptions.

In 2016, Oxfam exposed Mauritius as one of the world’s 15 worst corporate tax havens in its report ‘Tax Battles.’

On 28 May, 2019, the Tax Justice Network launched the Corporate Tax Haven Index (CTHI). Tax Justice Network Africa cited Mauritius as “among the most corrosive corporate tax havens against African countries”.

Company loans from Mauritius and nine other tax havens to African countries total over $80 billion. This means that for every $6 of foreign investment in Africa, $1 was a company loan from a tax haven.

22 July 2019

ICIJ: Mauritius Leaks

Led by the International Consortium of Investigative Journalists (ICIJ), the investigation is a collaboration by 54 journalists in 18 countries. More than 200 000 documents from the Mauritius office of a prestigious offshore law firm are at the heart of the investigation.

The documents offer a rare window into corporate tax avoidance in countries in Africa, the Middle East and Asia. The documents include emails, contracts and business plans provided by some of the world’s biggest players in finance and law.

It was a whistleblower that helped kickstart our Mauritius Leaks investigation after we reported on the region for Paradise Papers. Our African partnership coordinator, Will Fitzgibbon, takes you behind the scenes of the reporting that followed.

The documents offer a rare window into corporate tax avoidance in countries in Africa, the Middle East and Asia. The documents include emails, contracts and business plans provided by some of the world’s biggest players in finance and law.

It was a whistleblower that helped kickstart our Mauritius Leaks investigation after we reported on the region for Paradise Papers. Our African partnership coordinator, Will Fitzgibbon, takes you behind the scenes of the reporting that followed.

17 July 2019

China Briefing Magazine: The New Foreign Investment Law in China

China has faced a deluge of international criticism over its treatment of foreign businesses and the perceived slow pace of market opening over the past year. Looking to restore the confidence of foreign investors, China passed a new Foreign Investment Law in March this year. The law establishes a new framework to govern foreign investment in China and addresses a number of common concerns among overseas businesses. Critics, however, have questioned the extent to which the law addresses these issues in practice, pointing to the law’s at times broad and vague language. To make sense of the changes, this issue of China Briefing magazine offers a comprehensive analysis of China’s new Foreign Investment Law.

15 July 2019

UK: FRC consults on enhanced Ethical and Auditing Standards

The Financial Reporting Council (FRC) has today issued a consultation proposing important changes to the UK’s Ethical and Auditing Standards. The FRC proposes to set more stringent ethical rules for auditors, in response to findings from recent audit enforcement cases and from audit inspections. In response to feedback from investors, the FRC also proposes to enhance the quality and content of auditor’s reports in order to improve transparency about what is found in the course of an audit.

Key changes proposed include:

- A clearer and stronger ‘objective, reasonable and informed third party test’ which requires audit firms to consider whether a proposed action would affect their independence from the perspective of public interest stakeholders rather than another auditor. This is supported by additional material to encourage a wide-ranging assessment, which considers both the spirit and the letter of the standard.

- Enhancing the authority of the Ethics Partner function within audit firms, in order to ensure firm wide focus on ethical matters and the public interest, and to require reporting to those charged with governance where an audit firm does not follow the Ethics Partner’s advice.

- The list of prohibited non-audit services that auditors of Public Interest Entities (PIEs) can provide to audited bodies has been replaced with a much shorter list of permitted services, all of which are ‘closely related’ to an audit or required by law and/or regulation. No other services can be provided.

- The requirement for the auditors of all UK listed entities to include in their published auditor’s reports the performance materiality threshold used in the audit.

Further detailed amendments to individual standards clarify the auditor’s responsibilities when considering whether the bodies they have audited are compliant with relevant laws and regulations, and when checking there are no material misstatements in the ‘other information’ companies include in their annual financial reports (other than the financial statements which are subject to audit).

The FRC recognises that there are a number of concurrent reviews of the UK audit market, including an Independent Review by Sir Donald Brydon looking at the quality and effectiveness of audit. These proposals are not intended to pre-empt the outcome of those reviews, or the direction of future government policy. They are focussed on improving current Ethical and Auditing Standards in the light of experience since the last major revision in 2016, to drive up the quality of audits being carried out in the UK, and to continue to promote public confidence in audit.

Supporting Documents

- Revised Ethical Standard and Exposure Draft (PDF)

- Changes to the International Standards on Auditing (UK) and International Standard on Quality Control (UK) - Exposure Drafts (PDF)

- Glossary of Terms (Auditing and Ethics) (PDF)

The consultation period closes at 5pm on Friday 27 September 2019.

Stephen Haddrill, the FRC’s Chief Executive said:

“Recent corporate failures and the FRC’s own enforcement work has shown that Standards need to be strengthened. Our audit inspections and enforcement activity continue to identify a lack of professional scepticism and independence as being key points of failure when things go wrong. The UK will only continue to attract high-quality global investment if investors have confidence in the independence of auditors and the means to have a better understanding of the critical judgements those auditors make. Our changes will strengthen and clarify ethical requirements in the public interest.”

McKinsey: Asia's future is now

For years, Western observers have talked about Asia’s massive future potential. But the future arrived even faster than expected. The question is no longer how quickly Asia will rise; it is how Asia will lead.

The continent is on track to top 50 percent of global GDP by 2040 and drive 40 percent of the world’s consumption, representing a real shift in the world’s centre of gravity.

12 July 2019

UK Economic crime plan 2019 to 2022

The economic crime plan sets out 7 priority areas that were agreed in January 2019 by the Economic Crime Strategic Board, the ministerial level public-private board charged with setting the UK’s strategic priorities for combatting economic crime:

- develop a better understanding of the threat posed by economic crime and our performance in combatting economic crime

- pursue better sharing and usage of information to combat economic crime within and between the public and private sectors across all participants

- ensure the powers, procedures and tools of law enforcement, the justice system and the private sector are as effective as possible

- strengthen the capabilities of law enforcement, the justice system and private sector to detect, deter and disrupt economic crime

- build greater resilience to economic crime by enhancing the management of economic crime risk in the private sector and the risk-based approach to supervision

- improve our systems for transparency of ownership of legal entities and legal arrangements

- deliver an ambitious international strategy to enhance security, prosperity and the UK’s global influence

11 July 2019

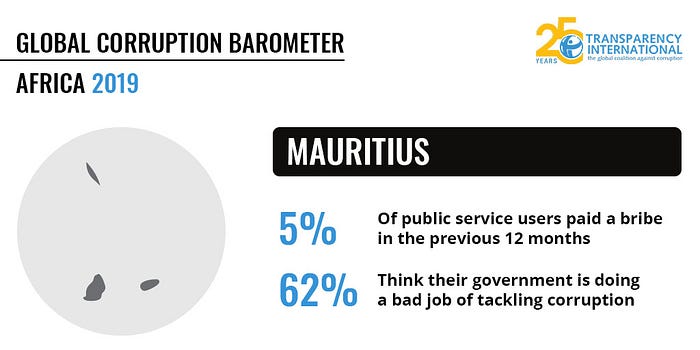

Transparency International: Is Mauritius at a tipping point in the fight against corruption?

According to the latest Global Corruption Barometer — Africa, very few Mauritians who accessed public services, like health care and education, had to pay a bribe for those services. However, given recent scandals and issues with corruption, impunity and nepotism, Mauritians still see institutions and groups like parliamentarians, the police and the prime minister as corrupt. Additionally, about 60 per cent of Mauritians think that corruption is on the rise and that the government is doing a bad job at tackling it.

10 July 2019

Transparency International: Global Corruption Barometer - Africa 2019

Global Corruption Barometer – Africa, is the largest, most detailed survey of citizen views on corruption and experiences of bribery in Africa.

Released on African Anti-Corruption Day, the report includes recommendations on how the international community can reduce the negative impact of corruption in Africa, particularly on the poorest and youngest members of society who are disproportionately affected.

Global Corruption Barometer – Africa captures people’s experiences and perceptions of corruption in 35 countries and territories. Transparency International partnered with Afrobarometer, who spoke to 47,000 citizens between September 2016 and September 2018 about their perceptions of corruption and their direct experiences of bribery.

The countries surveyed are: Benin, Botswana, Burkina Faso, Cameroon, Cape Verde, Cote d'Ivoire, DRC, Eswatini, Gabon, Gambia, Ghana, Guinea, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritius, Morocco, Mozambique, Namibia, Niger, Nigeria, Sao Tome and Principe, Senegal, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Tunisia, Uganda, Zambia and Zimbabwe.

The survey includes questions on how citizens perceive corruption in government and public institutions and whether citizens pay bribes for essential services, like water, electricity and education.

The new survey follows the previous edition of the Global Corruption Barometer for Africa, last published in 2015.

04 July 2019

Quantum Global Group Announces Closure of Investigation by the Swiss Attorney General

The Swiss Attorney General’s Office has closed all investigations into the events surrounding Jean-Claude Bastos and the Quantum Global Group as of 27 June 2019. With the termination of all investigations, Jean-Claude Bastos has taken a further step towards his complete rehabilitation against the false and unsubstantiated allegations made against him and the Quantum Global Group.

The termination of the investigation against unknown offenders follows the release of Mr. Bastos from custody in Angola at the end of March, after the Angolan authorities dropped all charges against him and confirmed that no charges would be brought against him or his related companies. The Attorney General of Angola also confirmed this in writing to the authorities in Mauritius and the Office of the Attorney General of Switzerland in Bern.

The Attorney General’s order to cease the investigation follows the conclusion of various legal proceedings in Switzerland and before the High Court in England, all resulting in favour of the Quantum Global Group and its founder, Jean-Claude Bastos. In these proceedings the English High Court clarified that the activities of Quantum Global Group and Mr. Bastos were executed in accordance with commercially valid and legally binding contracts.

Subscribe to:

Comments (Atom)